Tenured Unenrolled Campaign Resource Page

The Tenured Unenrolled campaign is a 3 email touch campaign meant to target employees who have been with their company for 90 days or more and are still eligible to enroll in their DC plan, causing them to miss out on valuable workplace benefits that Fidelity provides.

These benefits offer tools and resources to help with budgeting, saving and planning for retirement – empowering employees to meet both short- and long-term financial goals. In addition to retirement savings, participants can learn about and take advantage of other Fidelity workplace offerings (based on plan availability) such as:

- Heath Savings Account (HSA)

- Goal Booster

- Student Debt

Participants can also learn more about the importance of taking advantage of their workplace benefits by visiting our pre-login education page.

What is the call to action?

- The primary call to action is to enroll in your DC plan

- The secondary call to action to learn more and take advantage of additional products, tools and resources available in your plan

Employer Discretionary Contribution Email Trigger

The campaign also contains an ad-hoc, email only touch sent to participants in plans that fund discretionary accounts (i.e., profit sharing plans) and have received a contribution. Participants will receive this email if/when they receive their first contribution from their employer.

Unenrolled Secure 2.0 Regulatory Disclosure

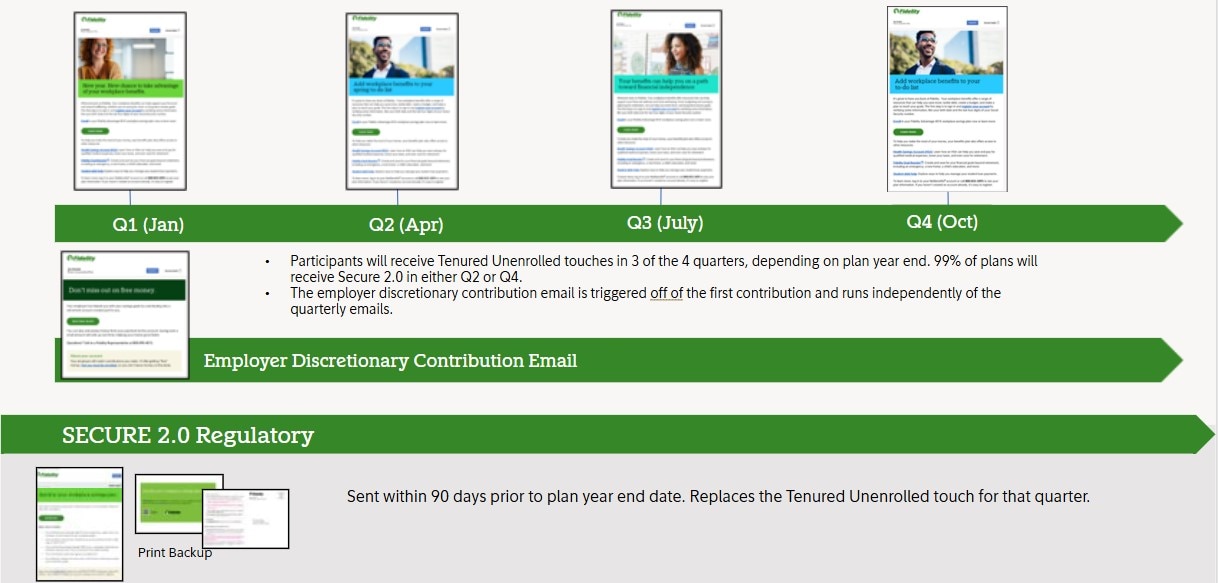

Secure 2.0 is a separate, legally required campaign that is triggered every year 90 days before the plans fiscal year end that fulfills our regulatory requirement. It will make participants aware that they are eligible to enroll in their workplace savings plan and are match eligible. This email serves as the replacement of the Tenured Unenrolled touch for that quarter.

Timeline of communications:

Fidelity-deployed Tenured Unenrolled campaign content

Please Note: Each email contains a button at the top to allow participants to view a Spanish translated version of the email in their web browser. Below are communication samples, including the Spanish translations.

| Q1 Sample | English Email

Spanish Email |

| Q2 Sample | English Email

Spanish Email |

| Q3 Sample | English Email

Spanish Email |

| Q4 Sample | English Email

Spanish Email |

| Secure 2.0 Regulatory Sample | English Email

Spanish Email English Postcard |

| Employer Discretionary Contribution Sample | English Email

Spanish Email |

How is the Tenured Unenrolled campaign delivered?

Communications are sent for each touch through checking the following order: Employee-provided email (if provided consent to send legally required information electronically), employer-provided emails flagged as safe harbor (if no employee-provided email address on file).

More Resources to drive employee engagement:

We've provided you a toolkit that can be used as part of an internal communications strategy (or stand-alone), to help your employees understand how to enroll in their workplace savings plan.

| Compound interest infographic | Show employees the benefit of a workplace savings plan and the power of small contributions

English | Spanish |

| One-pager | Encourage employees to enroll in their workplace savings plan

English | Spanish |

| Digital signage | Encourage employees to log in to their Fidelity accounts and take the next steps with their benefits. Leverage the editable PDF to tailor the message with specific details, such as adding your company logo, plan specific Fidelity phone # and the plan ERISA disclosure (if needed)

English Easy Enroll (PDF) | Easy Enroll (JPG) | Easy Enroll (PPT) Standard Enroll (PDF) | Standard Enroll (JPG) | Standard Enroll (PPT) Spanish Easy Enroll (PDF) | Easy Enroll (JPG) | Easy Enroll (PPT) Standard Enroll (PDF) | Standard Enroll (JPG)| Standard Enroll (PPT) |

| Wallet card | Prepare employees with everything they will need to get started with their benefits

English | Spanish |

| 401k/403b video | Help employees understand the value of a 401k/403b with this video:

Fidelity.com/401kRecipe Fidelity.com/recipe (Tax Exempt Plan version) |

| Other resources | Enrollment Short Intranet Copy

Article: What is a 401k/403b, anyways? |